Most consumers are stunned upon learning about diamond resale value. Our perception is often misled by inflated retail prices and other assumptions. Many of us expect diamonds to be worth exactly what we paid for them! But that is never the case. It’s typically worth only a fraction of the retail price.

Retail prices and insurance appraisals have absolutely no bearing on the market value of a diamond. With a deeper understanding of the market and factors that go into pricing, you can have more practical expectations. This way you won’t feel blindsided by your offer.

Do diamonds depreciate?

The market for diamonds isn’t as liquid as the markets for things like gold and silver. Not only are the diamonds not as easily recycled, but many sellers expect far too much money because of the retail markup they paid. There just isn’t as much demand for resale, causing the diamond to start depreciating as soon as it is bought.

THE REALITY OF THE DIAMOND RETAIL INDUSTRY

Diamonds are a massive industry, and there’s no question it has economic and societal value. However, like with any major industry, diamond retail has its own drawbacks and secrets.

Here are a few things you may not know about the industry and the reality of diamond prices:

- Retail diamond prices are often inflated due to the costs associated with running a physical store. Retail outlets have to pay rent, staff, and other overhead expenses, which factor into the price of the diamond. This means customers end up paying a premium for the convenience of shopping in a physical store.

- Heavy advertising. Prominent jewelers that heavily advertise online and on television often inflate the cost of diamonds. Every advertisement or promotional campaign costs money, and these expenses get passed onto the consumer. They’re added to the overall purchase price of the diamond jewelry. As a result, customers not only pay for the diamond but for the brand’s advertising expenditure. Such branding efforts are made to instill trust and recognition among consumers. However, it’s essential to remember that this added value from advertising doesn’t change the intrinsic value of the diamond or piece. It’s only worth what it’s worth.

- The diamond industry is notorious for its lack of transparency and regulation. This means retailers can charge consumers whatever they want for their diamonds, without any accountability. In rare cases, since diamond grading isn’t a pure science, it’s an art, retailers can also manipulate the grading of diamonds, making lower quality diamonds appear more valuable than they actually are by leaning towards better grades.

- Diamonds are not a finite resource. Despite what the diamond industry would like you to believe, there is actually an abundance of diamonds in the world. In fact, diamonds are more common than most people realize. The diamond industry has created the illusion of scarcity by controlling the supply of diamonds, but in reality, there are more than enough diamonds to go around.

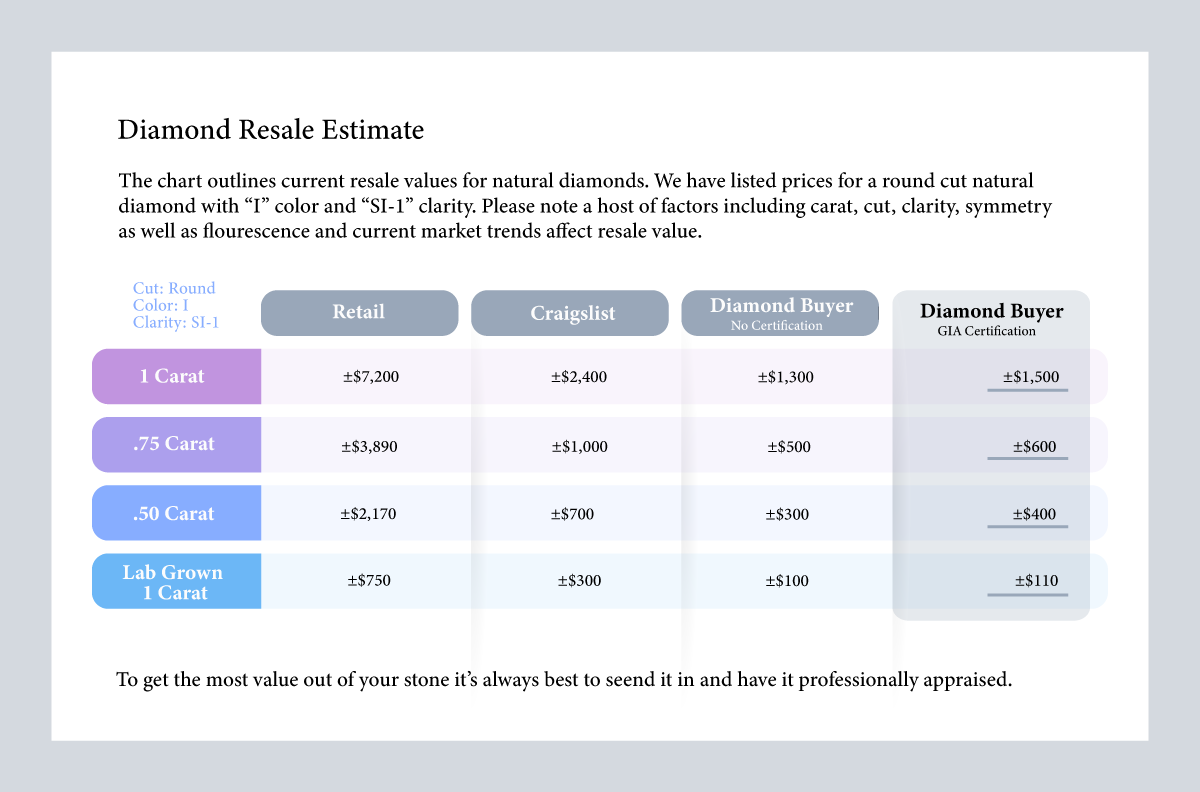

Diamond Resale Value Chart

First of all, these numbers are estimates. There are many factors that affect the value of your stone.

Retail Price: This represents the figure you’ll encounter when stepping into a traditional brick-and-mortar jewelry store. If you’re strolling through your local mall or visiting a nearby jeweler, this is the rate that will typically greet your eye.

Craigslist / E-Bay: When navigating the terrain of peer-to-peer selling platforms like Craigslist, this is the ballpark you’ll find for diamond transactions. While there are online options, they often deduct an extra 20% commission for diamond sales. It’s important to exercise caution, especially when dealing with high-value diamonds, to ensure both physical safety and protection against potential deception when engaging in direct transactions with individuals.

Diamond Buyer no certificate: If you decide to part ways with your diamond and opt to sell it to an online diamond buyer, this is the valuation you can anticipate if your stone is not certified. Certified stones will always fetch more than non-certified diamonds.

Diamond Buyer GIA certificate: This is the price range that diamond buyers would typically pay for diamonds that are GIA certified. If your stone is not certified by GIA, but has a different Lab certification, the average price it will fetch will be a little lower than listed above. GIA is the standard lab, and other grading labs tend to be more lenient in their appraisals, leading to inflated color or clarity. This is why sellers typically use other labs, because they know they will get a higher grading report, even though it is not accurate.

How is the resale value of a diamond determined?

Unlike precious metals, which can be valued simply based on their purity, weight and market prices, diamonds require more careful evaluation. Quality isn’t just about the elemental content or the way a stone looks; it’s about details that can’t be seen by an untrained, naked eye.

The resale value of a diamond is based solely on its quality in various categories. In their assessment, the appraiser will consider what are commonly called the “4 C’s” of diamonds listed below.

However, these are not the only factors as symmetry, fluorescence, shape and market trends also play a role.

- Carat: The weight of the diamond, measured in carats.

- Cut: The shape and faceting of the diamond. The uniqueness, trendiness, and sparkle of the diamond play a role in how desirable (and therefore valuable) it will be on the diamond market.

- Color: The hue and richness of the stone (white, yellow, pink, etc.). As with cut, consumer trends in colored diamonds affect value.

- Clarity: How many flaws are in the stone, measured by how clear or cloudy it is. A clearer stone means fewer flaws and a higher price.

Why is there a discrepancy between retail and resale?

- Brand names retailers have a cost of their own

Household diamond companies like Kay Jewelers, Jarred’s, Zales, and even Blue Nile have established names that people associate with quality (regardless of whether that association is accurate). They aren’t afraid to capitalize on their prestige to cover huge overheard storefront and marketing costs and make a profit. Often retailers mark up the cost of a stone by as much as 10X the value. Meaning a stone that they paid $400.00 is being sold to you for $3,200.00. If you purchased your stone at a mall retail outlet, you may be surprised upon learning the true value.1 - The market fluctuates over time.

Again, it’s hard to say how much your diamond will be worth at the moment of sale until you have a buyer’s offer. Fortune just released an article outlining how the natural diamond market is being undercut by the lab grown diamond business. Since lab grown diamonds are much cheaper to buy, it’s driving the demand for natural stones down, which in turn is diminishing the value.

Professional appraisal from an experienced buyer is the best way to get an accurate market value.

Insurance appraisals vs. Resale value

The value determined by an insurer does not represent the value of your stone. It is a replacement value. During an insurance appraisal, the appraiser is evaluating how much costs to replace the item. Because you are paying the insurance company for that protection, the more inflated the dollar amount, the larger the premium they can charge (which also makes you feel safer). For this reason, it is standard for insurance companies to exaggerate an item’s value. They only have to replace it, if it’s lost or stolen.

A resale appraisal, on the other hand, is based on the current market value of the diamond and factors in depreciation. The market prices are set by the Rapaport Report — this is the industry standard.

Bottom Line: Do diamonds have resale value?

Diamonds do have a resale value, but it is not equivalent to retail pricing. Unlike other investments, such as gold or real estate, diamonds do not appreciate in value over time. This means customers who buy diamonds from retail outlets are unlikely to recoup their investment if they decide to sell a diamond or diamond ring later on.

Although it’s important to manage expectations with regard to diamond resale values, you’re still recouping money on something you no longer want. Even chipped or fractured diamonds retain value.

Diamonds USA will work hard to get you the fairest, most accurate offer for your stones. And if for any reason you’re not satisfied, or you don’t understand how the offer amount came about — we’re available to walk you through the appraisal. And we can always send your diamonds back to you free of charge.

If you have further questions about our assessments or the value of your diamonds, contact us or request your free Appraisal Kit now.

Sources:

Post Revisions:

There are no revisions for this post.

Leave A Comment